Tenancy Deposit Disputes: What you need to know and how to be eligible for a claim

September 22, 2021

How can I be eligible for a Tenancy Deposit Claim?

Tenancy Deposit Disputes: What you need to know and how to be eligible for a claim.

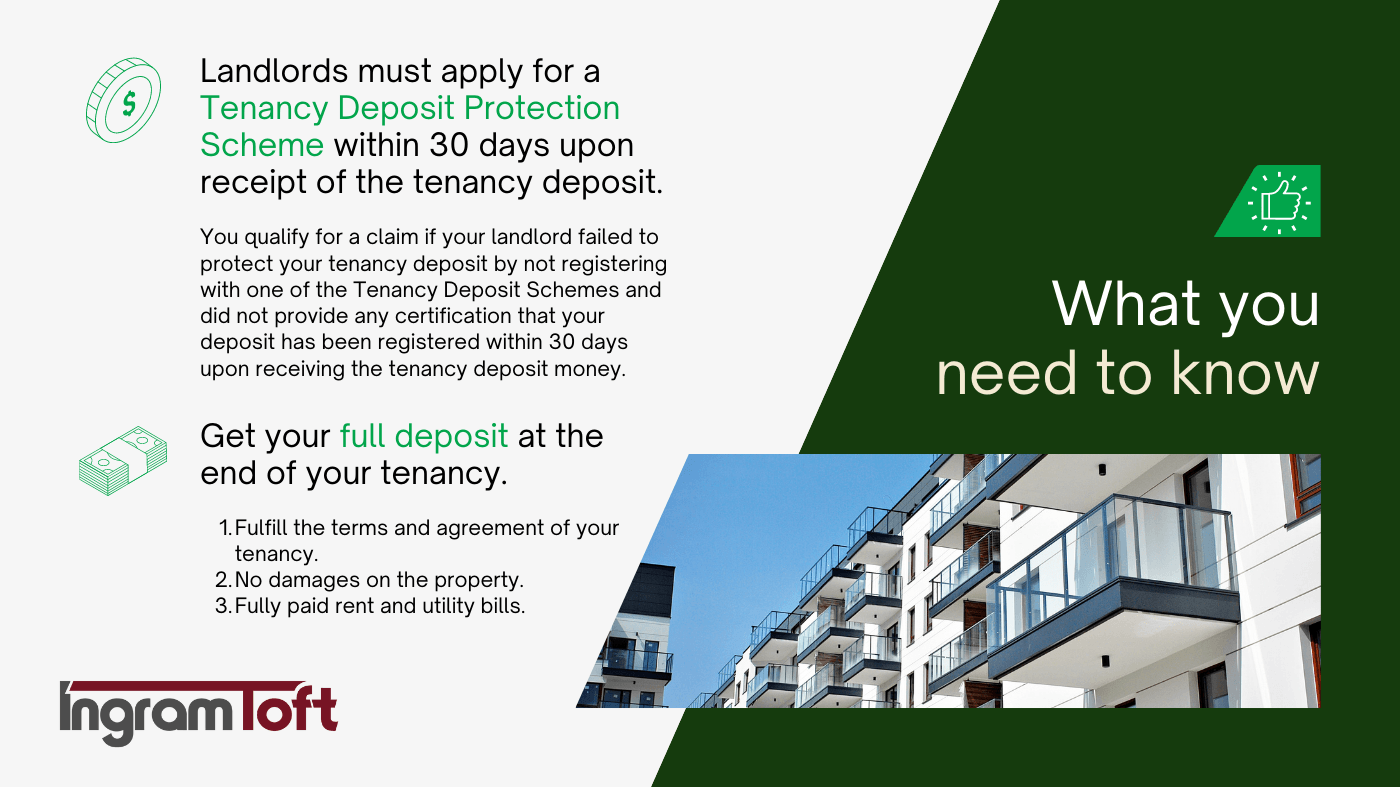

When renting a home normally the landlord will ask the tenant to pay a deposit and the landlord uses tenancy deposit as a way to protect them in cases when a tenant leaves property or home without paying rent and caused damages to the property. According to the law (Housing Act 2004), tenancy deposits paid on or after 6th April 2007, the landlord must protect the tenant’s deposit money in a Tenancy Deposit Protection Scheme

within 30 days upon receipt of the tenancy deposit.

For the landlord to comply with the law:

1. they need to belong to a scheme

2. they need to register the tenancy deposit through the database of the specific scheme

3. they need to pay the membership subscription fee or the tenancy deposit protection charge

There are only three (3) Tenancy Deposit Protection Scheme governed and protected by law:

1. Tenancy Deposit Scheme

2. Deposit Protection Service

3. My Deposits

At the end of your tenancy the landlord must return your deposit within 10 days upon agreement of how much you are getting back.

How do you get the full return of your deposit at the end of your tenancy?

1. Fulfil the terms and agreement of you tenancy.

2. No damages on the property.

3. Fully paid rent and utility bills.

In cases wherein any of the above mentioned was not followed or observed by the tenant, the tenant will have to work this out with the landlord with an agreement on how much will be deducted from their tenancy deposit. Until they reached into an agreement or while the tenant is in dispute with the landlord regarding the breach of agreement, the tenant’s deposit is still protected in the Tenancy Deposit Protection Scheme until the issue is sorted out.

How can I be eligible for a Tenancy Deposit Claim?

As mentioned earlier, the most important factor to qualify for filing a claim is that the payment of your tenancy deposit must be on or after 6th April 2007. Any payments before the said date will not be considered. The second qualification for filing a claim

is that if your landlord failed to protect your tenancy deposit by not registering with one of the Tenancy Deposit Schemes and did not provide any notice or certification that your deposit has been registered within 30 days upon receiving the tenancy deposit money.

If you believed you are eligible to qualify for a Tenancy Deposit Claim, having a professional claims analysts

like us on your back will make things smoother and ensuring success with your claim.

Have you or someone you know been a victim of a romance scam? It can be a painful and isolating experience, but help is available. At [Your Company Name], we specialize in supporting victims of online romance fraud by offering professional guidance to help recover lost funds. Our team understands the complexities of these scams and is committed to assisting you every step of the way toward compensation and peace of mind. Don’t let scammers get the last word—reach out to explore your options for financial recovery today

Discover 30 expert tips to protect your finances from cryptocurrency scams in the UK. Our comprehensive guide covers the essentials of cryptocurrency, identifies common types of crypto frauds, and provides actionable advice to shield yourself from these scams. Whether you're a novice or an experienced crypto user, learn how to safeguard your digital assets and navigate the process of claiming compensation if you fall victim to a scam. Stay informed and secure in the ever-evolving world of cryptocurrency.