Latest Updates on Compensation Claims

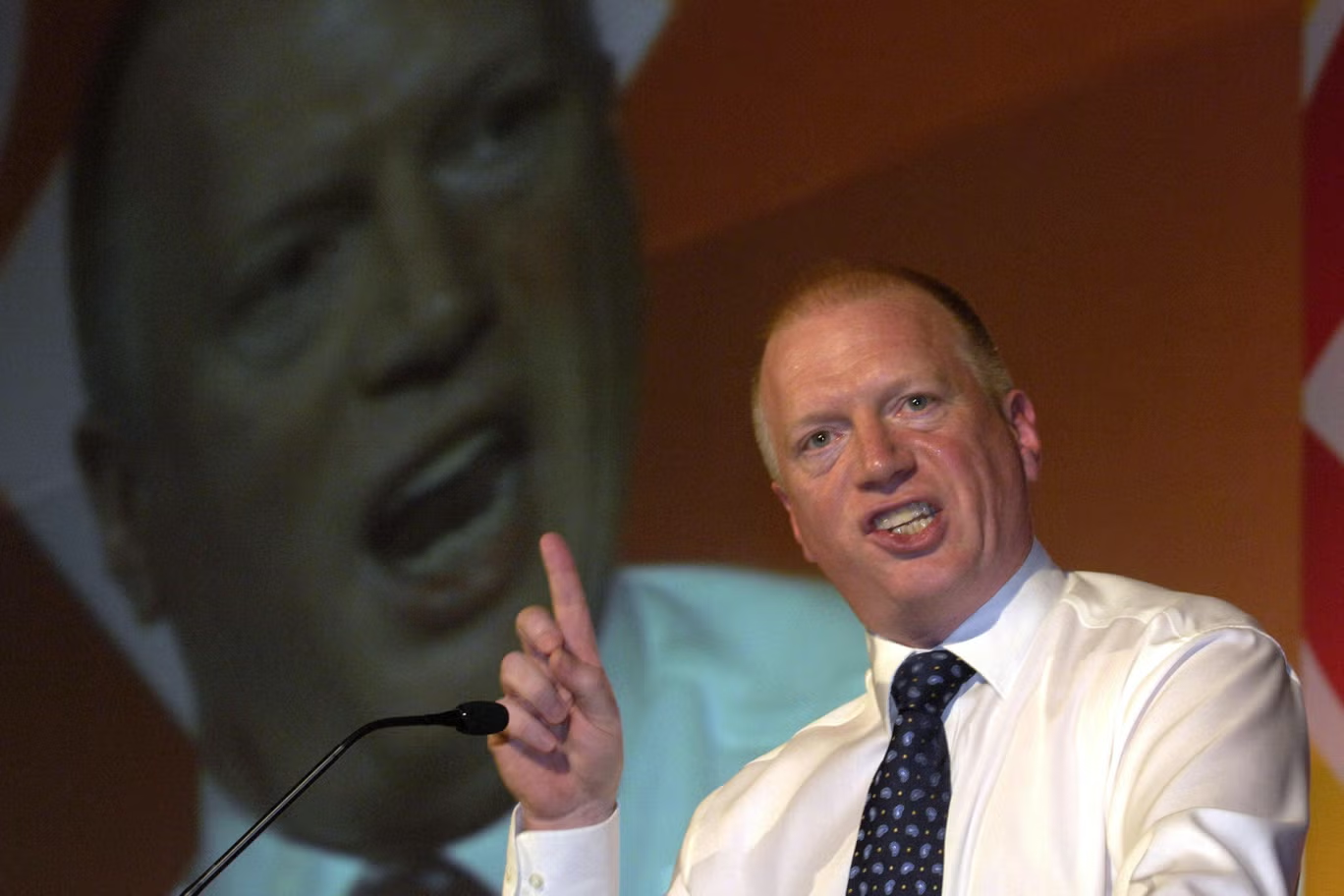

Martin Lewis Urges Motorists: Submit Your Car Finance Claim Before July Ruling

Consumer finance expert Martin Lewis is encouraging drivers to take action now rather than wait for a Supreme Court decision expected this summer on hidden car finance commission charges.

During a recent Money Show Live special, Martin Lewis addressed growing public interest in the ongoing investigation into Discretionary Commission Arrangements (DCAs) - hidden charges applied to car finance deals by brokers and lenders between 2007 and 2021.

💬 “If you want to get ahead of the queue and make sure all your details are correct, I’d recommend putting a claim in now,” Martin advised. “Just make sure you use a free claims service.”

What's the Latest on Car Finance Compensation?

The Financial Conduct Authority (FCA) is investigating widespread use of DCAs — where some car dealers and brokers earned higher commissions by inflating customer interest rates.

A legal case surrounding these practices was heard by the Supreme Court in April.

A decision is expected around July 2025, although no exact date has been confirmed.

Until then, all DCA-related car finance claims remain paused.

Will You Be Paid Automatically?

Martin confirmed what the FCA has already stated:

If payouts are ordered following the ruling, they will be automatic — no paperwork needed.

However, submitting a claim now could help streamline any potential compensation, especially if your contact or vehicle details have changed over the years.

How Much Could You Get?

According to previous estimates by Martin Lewis and his MoneySavingExpert team:

Roughly 40% of car finance deals made between April 2007 and January 28, 2021 may have involved a hidden DCA.

The average compensation payout could be around £1,100 per deal.

This applies to finance on cars, vans, campervans, and motorbikes.

Should You Wait or Claim Now?

Here’s Martin’s take:

You can wait: If the Supreme Court rules in favour of compensation, and you’re eligible, you will be contacted and paid automatically.

Or claim now: Doing so could help “get your admin in early” and ensure you’re already in the system should a payout process begin.

Important: Only use trusted and free services to register your claim.

Key Takeaway for Car Finance Customers

If you’ve had car finance within the relevant timeframe, you may be eligible for a payout — but the best way to prepare is to either submit your information now through a free, no-win-no-fee service or wait for the FCA and Supreme Court outcome.

Likely ruling date: July 2025

Potential refund: £1,100+

Claim type: Discretionary Commission Arrangements (DCA)

Disclaimer: This update is for informational purposes only and does not constitute legal or financial advice. Always use official, regulated, or free claim services to avoid unnecessary fees.

FCA Considers Industry-Wide Redress Scheme for Car Finance Mis-Selling

FCA Considers Industry-Wide Redress Scheme for Car Finance Mis-Selling

Millions could be in line for automatic compensation

The Financial Conduct Authority (FCA) has announced that it may launch an industry-wide compensation scheme for car finance customers, following concerns about undisclosed commission arrangements between lenders and car dealers.

Background

Between 2007 and 2021, some car dealers received hidden commissions for increasing the interest rates offered to car buyers.

In October 2024, the Court of Appeal ruled these practices unlawful.

The Supreme Court is due to make a final decision later in 2025.

What Happens Next?

If the Supreme Court upholds the ruling, the FCA says it’s likely to consult on a redress scheme.

This would require lenders to proactively identify and compensate affected customers.

Consumers would not need to file complaints payouts would be automatic and based on FCA guidelines.

Potential Payouts

Martin Lewis warns the total compensation could be tens of billions of pounds.

Lenders have already set aside significant reserves to prepare for potential claims.

The overall cost to the industry could reach up to £44 billion.

Why This Matters

A redress scheme would simplify the process:

No need to use a claims management company

Consumers likely to receive full payouts

Reduces complaints backlog for firms and regulators

Timeline

The FCA will confirm its decision within six weeks of the Supreme Court ruling.

FCA Statement Highlights:

“If we conclude that widespread consumer harm occurred, we will consult on a redress scheme. Firms would be responsible for compensating customers and we would ensure proper rules and oversight are in place.”

CCN Insight:

This announcement could mark the largest consumer redress scheme since PPI. If you financed a car between 2007 and 2021, stay informed—your lender could owe you money.

Stay tuned to CCN for updates as the Supreme Court decision approaches.

Car Finance Mis-Selling: What the Supreme Court Case Means (May 2025)

The UK Supreme Court is reviewing whether car finance deals with hidden commissions were unlawful. Even if the previous ruling is overturned, a refund scheme for another type of mis-selling is still expected.

This could lead to billions in payouts for customers mis-sold car finance. Here’s what you need to know.

Two Types of Mis-Selling Claims

1. Commission Non-Disclosure:

- Consumers weren’t told about broker commissions.

- This is the focus of the current Supreme Court hearing.

- Affects up to 99% of car finance agreements.

2. Discretionary Commission Arrangements (DCAs):

- Brokers increased interest rates to earn higher commission.

- Not part of this court case but under FCA review.

- Applies to around 40% of agreements before 2021.

What Happens Next?

Once the Supreme Court rules, the FCA will respond within 6 weeks. Possible outcomes:

✅ Most likely: Court overturns previous ruling → refunds for DCA cases only.

✅ Possible: Court upholds ruling → refunds for 99% of finance cases.

🚫 Unlikely: Court blocks both → minimal or no refunds.

Expected redress could range from £1 billion to £30 billion.

Timeline of Events

Jan 2024 – FCA investigates hidden commissions in car finance.

Oct 2024 – Court of Appeal rules some agreements unlawful.

Dec 2024 – FCA pauses complaint deadlines.

Mar 2025 – FCA confirms it will set up a redress scheme.

May 2025 – Supreme Court hearing begins (decision expected this summer).

Should You Make a Claim Now?

Car Finance Mis-Selling Scandal: What You Need to Know Published: 11 March 2025 | Source: FCA, Which? Court of Appeal

Car Finance Mis-Selling Scandal: What You Need to Know

Published: 11 March 2025 | Source: FCA, Which?, Court of Appeal

Summary

Millions of UK drivers may be owed compensation after a court ruled that hidden car finance commissions were unlawful. The FCA (Financial Conduct Authority) says it’s likely to launch a full redress scheme — meaning drivers may not even need to submit complaints to get their money back.

What’s the Issue?

Before January 2021, some car finance brokers were allowed to set interest rates at their discretion — and earn more commission the higher they set the rate. This encouraged overcharging without the customer's knowledge.

A Court of Appeal ruling in October 2024 confirmed this was unlawful. The Supreme Court is now set to review this in April 2025. If the appeal fails, the FCA says it is "likely to consult on an industry-wide compensation scheme."

Who Could Be Affected?

You may be impacted if:

You financed a car using a hire purchase or PCP agreement before 28 January 2021.

Your lender and broker had a discretionary commission agreement.

You weren’t made aware of how your interest rate was set.

Even if you’re unsure, your finance company must tell you if you ask.

How Much Could You Get?

Estimates suggest:

£6 billion to £16 billion could be paid out across the industry.

One consumer was refunded the difference between 5.5% and 2.49% interest, plus 8% annual interest on the overpaid amount.

Major banks like Lloyds, Barclays, Santander, and Close Brothers have already set aside £1.29 billion for expected claims.

What’s Next?

Supreme Court decision due in April 2025.

FCA will announce next steps within 6 weeks of that ruling.

Complaints deadline extended to 4 December 2025.

You will have up to 15 months to escalate to the Financial Ombudsman Service (FOS).

CCN Insight

This is shaping up to be one of the biggest financial scandals since PPI. CCN is monitoring developments closely and will continue to provide practical updates. If you financed a car before 2021, you could be owed thousands. Make sure you're informed and ready to act.

Disclaimer

This article is for general information only. CCN Claims is not providing legal or financial advice. For specific advice, please contact a solicitor or regulated claims expert.

Close Brothers Sets Aside £165M Amid Car Finance Scandall

Close Brothers Sets Aside £165M Amid Car Finance Scandal

Published: 12 February 2025 | Source: The Guardian, FCA

What’s Happening?

Close Brothers, one of the UK’s biggest motor finance providers, has announced it will set aside up to £165 million to cover expected compensation and legal costs related to the car finance mis-selling scandal.

This move follows a “thorough assessment” of the situation after the October 2024 Court of Appeal ruling, which declared that hidden car loan commissions were unlawful.

Background: What’s the Scandal About?

Between 2007 and 2021, brokers and dealerships were allowed to set customer interest rates through discretionary commission arrangements (DCAs) — earning higher commissions on higher rates. This led to overcharging without customers’ knowledge.

The FCA banned this practice in 2021, but thousands of complaints have since emerged, and a landmark court case in 2024 ruled that lenders like Close Brothers acted unlawfully by paying undisclosed commissions.

Financial Impact So Far

Close Brothers has cancelled its dividend and is planning to raise £400 million to stabilise its finances.

The bank warns that the final cost could be higher or lower depending on ongoing appeals and FCA decisions.

Lloyds has already put aside £450 million, and total industry redress may reach £8–£13 billion.

Despite the financial hit, Close Brothers says it remains "well placed" to absorb the impact.

What Happens Next?

Supreme Court appeal: Close Brothers and FirstRand have been granted permission to appeal the Court of Appeal ruling.

The FCA will announce by December 2025 whether a full redress scheme will be introduced.

The Treasury has even applied to submit evidence, citing potential economic consequences of the ruling.

CCN Insight

This move by Close Brothers signals how serious the fallout from the scandal could be. If you've taken out car finance between 2007 and 2021 especially if you weren’t told how your rate was decided you could be eligible for a significant refund.

CCN urges customers to keep an eye on the FCA’s decisions in late 2025 and consider lodging a complaint if they suspect overcharging.

Disclaimer

This article is provided by CCN Claims for informational purposes only. We do not offer legal or financial advice. For individual circumstances, please contact a qualified professional.

Investor Confidence Shaken by Car Finance Scandal Uncertainty Published: 19 January 2025 | Source: The Guardian, FCA

Investor Confidence Shaken by Car Finance Scandal Uncertainty

Published: 19 January 2025 | Source: The Guardian, FCA

What’s New?

UK car finance mis-selling is no longer just a consumer issue it’s now rattling investor confidence and raising questions about the UK's regulatory environment.

City bosses, US investors, and financial leaders are warning that the lack of clarity over compensation liabilities, and fears of retrospective rule enforcement, are making it harder to operate and invest in the UK.

Key Industry Voices

Kuba Fast, CEO of Chase UK (JP Morgan):

“We followed the rules now we’re being penalised. It’s difficult to operate in an unpredictable environment.”

Andy Briggs, CEO of Phoenix Group:

“Even though we don’t do car finance, US investors are spooked. Every meeting started with questions about this scandal.”

Why Are Investors Worried?

A shock Court of Appeal ruling in October 2024 widened the scope of liability, declaring non-disclosure of commission arrangements as unlawful, beyond just DCAs.

Analysts now estimate potential lender payouts could rise from £13 billion to £30 billion, according to Moody’s.

Some investors fear regulatory ‘retrospection’ where firms that complied at the time are still being punished years later.

Background

The FCA banned discretionary commission arrangements (DCAs) in 2021.

DCAs let dealers set customer interest rates, giving them higher commissions for more expensive loans.

The Court of Appeal ruling has opened the floodgates to new claims, not only for DCAs, but also for any undisclosed commission deals.

This could have a PPI-style fallout, as claims firms gear up for large-scale legal action.

What’s Next?

Supreme Court hearing begins 1 April 2025 — Close Brothers and FirstRand are appealing the decision.

The FCA maintains that it is not enforcing rules retrospectively, but is reviewing whether firms complied with existing rules on fair treatment and disclosure.

FCA boss Nikhil Rathi has written to the Prime Minister and Chancellor promising more clarity later in 2025.

CCN Insight

The scandal is no longer just about car loans — it’s impacting UK market stability and investor sentiment. The scope of potential compensation claims is still growing, and future rulings could influence other consumer finance sectors like insurance, furniture, and retail credit.

If you took out any finance between 2007 and 2021, you could be eligible for redress. We recommend staying informed and submitting a complaint if you believe you were mis-sold.

Disclaimer

This article is provided by CCN Claims for informational purposes only.

UK Chancellor Intervenes in Car Finance Mis-Selling Case

UK Chancellor Intervenes in Car Finance Mis-Selling Case

Published: 22 January 2025 | Source: Financial Times, GlobalData

What’s the Latest?

Chancellor Rachel Reeves has made a formal intervention in the high-profile car finance mis-selling case, warning that unchecked compensation payouts could severely damage the UK banking system and economy.

The Treasury has applied to join the Supreme Court case, set for hearing in April 2025, amid fears that lenders could face up to £44 billion in payouts — nearly on par with the infamous PPI scandal.

Why Is the Government Getting Involved?

80% of new cars in the UK are bought on finance disruption in this sector could ripple across the entire auto and finance industry.

Reeves warned the court that the fallout could result in:

Tighter credit for consumers

Higher loan costs

A chilling effect on investor confidence in UK financial services

The Treasury emphasised it's not siding with banks, but is focused on economic stability and proportionality in compensation.

Case Background

In October 2024, the Court of Appeal ruled that car loan commissions kept secret from customers were unlawful.

This opened the door to claims dating back to 2007, affecting major lenders like Close Brothers, FirstRand (MotoNovo), Lloyds, Santander, and more.

The Supreme Court will now hear appeals from lenders seeking to overturn this ruling.

What’s at Stake?

Santander has already set aside £295 million.

Close Brothers: £165 million.

HSBC analysts warn total liabilities may hit £44 billion.

Some lenders are reportedly reconsidering their UK market presence due to the risks.

CCN Insight

The Treasury’s move is highly unusual a rare intervention in an ongoing legal case. This signals how seriously the government views the potential economic disruption.

But make no mistake: the legal and regulatory pressure remains strong. Lenders could still be forced to compensate millions of consumers, especially if the Supreme Court upholds the October ruling.

What This Means for You

If you took out any type of car finance between 2007 and 2021, you could be affected — regardless of the vehicle or lender.

Now is the time to check your agreements and register a potential claim.

Disclaimer

This article is provided by CCN Claims for informational purposes only. It does not constitute legal advice. Please consult a qualified professional regarding your specific circumstances.

Martin Lewis: Check for Energy Refunds Now – You Could Be Owed £100s

CHECKMillions of energy customers may be sitting on unclaimed refunds worth hundreds.

What’s Happening?

Energy companies are reportedly holding on to £3 billion in unused customer credit.

If you pay by Direct Debit, there’s a good chance you’ve built up excess credit during winter.

With warmer months ahead, now is the time to check and reclaim what’s yours.

What You Should Do:

Take a meter reading to ensure your bill is accurate.

Check your account balance – if you’ve got more than 1.5 months’ worth of payments in credit, you’re likely entitled to a refund.

Ask your energy supplier for the money back. Under current rules, they must refund you.

Keep a small buffer in your account to avoid future underpayments.

💬 Martin Lewis says:

“If you’ve got substantial credit, you’ve got too much. Ask for it back!”

📌 Real-Life Examples:

Diane got £800 refunded.

Liz reclaimed £500.

It’s fast, it’s free – and it’s your money.

Key Requirements:

You must pay by Direct Debit.

A working smart meter helps but is not essential.

If your supplier refuses, contact the Energy Ombudsman (free service).

Check if You’re Eligible

UK Housing Associations Accused of Mis-Selling ‘Affordable’ Homes as Service Charges Soar

Housing associations across the UK are under scrutiny following allegations of mis-selling “affordable” homes, with residents facing unexpected service charge increases of up to 400%. Buyers, many of whom were assured that costs would remain manageable, now find themselves trapped in financial hardship, struggling to pay soaring charges that have left some unable to sell their properties.

"We Were Mis-Sold an Affordable Home That’s No Longer Affordable"

Many residents entered shared ownership schemes believing them to be a cost-effective path to homeownership. Instead, they now face skyrocketing service charges:

Dalston, East London: Patrick Duffy saw his service charge rise from £95 to £706 per month.

Brighton: Residents at a Clarion Housing Association development report charges increasing from £120 to £390 per month in just three years.

Peabody’s Pickle Factory, Bermondsey: Advertised service charge of £247 per month was actually £406—a 60% discrepancy.

"This is ruining people’s lives," says George Andain, a homeowner in Brighton, whose debt is mounting as he struggles to afford his home.

Legal Action & Calls for Reform

The Social Housing Action Campaign is preparing legal action over these excessive and misleading service charges, demanding accountability from housing associations. The UK government has acknowledged the issue and proposed banning the sale of new leasehold flats—but this does not help those already trapped in rising costs.

Housing associations argue that external managing agents set service charges and deny profiting from them. However, residents demand transparency and accountability.

CCN’s Call to Action

At Compensation Claims News (CCN), we stand with homeowners who believe they were misled into unaffordable financial commitments. If you purchased a shared ownership home and have been affected by unexpected service charge increases, you may have grounds for a claim.

CCN Can Help You:

✔Assess whether your home was mis-sold

- Connect you with legal experts specializing in property mis-selling.

✔Provide updates on class actions and regulatory changes.

Don't suffer in silence—take action today!

File a Claim | Get Protected | Stay Informed

Source: The Guardian

Disclaimer: This article is based on publicly available information from The Guardian. CCN does not claim authorship of the original research but provides analysis and guidance for affected individuals.

Each UK SMB lost £11,000 to online fraud in 2024

FILE A CLAIMNew research reveals the strain placed on small and medium-sized businesses

By Fiona Briggs | December 13, 2024

According to new research released today, each of the 5.5 million small and medium-sized businesses (SMBs) in the UK lost an average of £10,800 this year due to fraud.

With hackers, scammers, and unethical shoppers becoming increasingly sophisticated, smaller businesses remain worryingly underprepared for attacks. Nine in ten senior executives admit they are concerned about their business's survival due to these ongoing threats.

The study, commissioned by Mollie, one of Europe’s fastest-growing financial service providers, found that over 54% of UK SMBs were victims of online fraud in 2024.

Most Common Types of Online Fraud

Phishing scams (58%) – Fraudsters posing as trusted companies to steal personal information via email.

Refund fraud (42%) – Customers abusing refund policies to claim reimbursements they aren’t entitled to.

Account takeovers (30%) – Unauthorized parties attempting to gain access to online business accounts.

Chargeback fraud (26%) – Consumers reversing legitimate transactions, leaving businesses at a loss.

Carding attacks (23%) – Criminals testing stolen cards at checkout, leading to spikes in failed transactions.

The Hidden Cost of Fraud

Beyond financial losses, SMBs are also losing valuable time. Mollie’s research revealed that businesses spend an average of 15 days (120 hours) per year dealing with fraud-related issues—resources that could have been spent growing their business.

Richard Wivell, Marketing Manager at Nemesis Now, shared his experience:

"Experiencing gateway attacks was costly and stressful. We dealt with fake orders, refunded fraudulent payments, and worked overtime with developers to manage thousands of malicious requests. Unfortunately, our previous provider lacked urgency, forcing us to take matters into our own hands."

Calls for Greater Protection for SMBs

Dave Smallwood, UK Managing Director of Mollie, emphasized the need for better fraud prevention tools:

"As the backbone of the UK economy, SMBs—especially e-commerce businesses—must be equipped with solutions to fight fraud effectively. Many small businesses cannot afford to cover even a single fraudulent incident, and without better support, business innovation and growth are at risk."

At Compensation Claims News (CCN), we recognize the financial and emotional toll online fraud takes on businesses. We advocate for greater protection, stronger policies, and proactive fraud prevention solutions to ensure UK businesses can operate securely. If you have been impacted by fraud, we encourage you to take action today.

File a Claim | Get Protected | Stay Informed

Landmark Ruling Exposes Unlawful Targeting of Vulnerable Gamblers

FILE A CLAIMA recent High Court ruling has sent shockwaves through the gambling industry, confirming that Sky Betting & Gaming unlawfully targeted a compulsive gambler with relentless marketing. The ruling highlights a widespread issue—predatory practices that exploit vulnerable individuals for profit.

For individuals affected by irresponsible gambling promotions, this case is a turning point. At Compensation Claims News (CCN), we help victims navigate the complexities of seeking compensation for financial and emotional harm caused by unethical gambling practices.

*The Case That Changed Everything*

Sam*, an individual struggling with gambling addiction, found himself bombarded with promotional offers from Sky Bet, despite clear signs of distress. Over two years, the company sent him nearly 1,400 marketing emails, leveraging behavioral tracking and profiling techniques to lure him into deeper financial ruin.

Despite taking multiple steps to self-exclude and curb his gambling, Sam was classified as a “high-value customer” and subjected to persistent engagement tactics. The company’s failure to recognize his addiction and refusal to act on red flags ultimately contributed to his financial downfall.

The High Court ruled that these actions were unlawful, emphasizing that compulsive gamblers cannot be deemed to have freely consented to targeted marketing based on their gambling history.

*What This Means for Other Affected Gamblers*

This ruling paves the way for other victims of predatory gambling marketing to seek justice. Many gambling companies collect and analyze vast amounts of customer data, often using it to encourage increased spending rather than ensuring responsible gambling measures.

If you or a loved one have been:

- Targeted by aggressive gambling marketing despite signs of addiction

- Misled by promotions that encouraged excessive spending

- Denied proper safeguards despite showing distressing gambling patterns

You may be entitled to compensation.

*How CCN Can Help*

At Compensation Claims News, we specialize in holding corporations accountable for unethical practices. Our team can:

✔ Review your case and assess your eligibility for a claim

✔ Help retrieve and analyze your gambling history to identify wrongful practices

✔ Guide you through the legal process of filing fo *Time to Take Action*

The High Court’s ruling is a reminder that gambling companies must be held responsible for their actions. If you have been affected, don’t wait—take the first step towards justice today.

*File a Claim Now* and reclaim what was wrongfully taken from you.

(*Name changed for privacy reasons.)

The UK Gambling Commission (UKGC)

The UK Gambling Commission (UKGC) has announced a series of regulatory changes aimed at enhancing consumer protection, including mandatory deposit limits for new players, increased transparency on customer funds, and the implementation of a statutory levy on gambling operators.

These changes, set to take effect from October 31, come amidst the country's efforts to modernize gambling regulations as outlined in the Gambling Act review white paper published in April 2023.

Under the new rules, all licensed gambling operators must require first-time depositors to set a financial limit before making their initial deposit. While some operators have already adopted similar measures, the update ensures that this requirement is standardized across the industry.

Players will be able to review and adjust their deposit limits at any time, and operators must remind them every six months to reassess their spending habits by reviewing account and transaction details.

“These rules will take good practice already offered by some operators and expand that so customers can expect the same standards across the industry,” the Commission stated.

The UKGC also plans to launch a short consultation to improve clarity on financial limits. This follows concerns raised by consumers regarding inconsistencies in how different operators apply and communicate deposit restrictions.

In addition to deposit controls, the UKGC addressed confusion surrounding the upcoming statutory levy, first announced in November. This levy will require licensed operators to contribute between 0.1% and 1.1% of their gross gambling yield (GGY), with exact rates varying depending on the type of gambling services provided and their associated risk factors.

To accommodate this change, the Commission will remove its existing requirement for operators to make annual financial contributions to research, prevention, and treatment organizations. This obligation, previously outlined in the Licence Conditions and Codes of Practice (LCCP), will become obsolete once the levy is in place.

While the exact date of implementation has not been confirmed, the measure is widely expected to come into effect on April 6. The Commission has assured licensees that they will be notified as soon as the date is officially finalized.

Another key element of the regulatory update focuses on ensuring transparency regarding the protection of customer funds. Currently, operators must disclose whether funds held in player accounts are safeguarded in case of insolvency, including the level of protection provided. This information must be available to customers at the time of their first deposit.

From October 31, any operator that does not offer protection for customer funds in the event of insolvency must actively remind users every six months of this status. The UKGC classifies protection levels into four categories: “not protected – no segregation,” “not protected – segregation of customer funds,” “medium protection,” and “high protection.”

“While there is no legal duty on gambling operators to protect customer funds in the event of insolvency, many of them do so voluntarily,” the Commission stated. “The changes will help consumers understand which operators protect their funds and which do not. This information will support them in making choices about who they gamble with.”

Tim Miller, the UKGC’s Executive Director for Research and Policy

Tim Miller, the UKGC’s Executive Director for Research and Policy, noted the importance of these changes in maintaining transparency across the gambling sector. “These changes illustrate our commitment to ensuring gambling is fair and open by improving consumer empowerment and choice,” Miller said.

“They will help consumers decide on deposit limits, enable them to keep track of their spending, and ensure they are fully aware of what happens to their funds should an operator become insolvent.”

SOURCE: YOGONET GAMING NEWS

DISCLAIMER: This article is based on publicly available information and is intended for informational purposes only.

Scots More Intimidated by Banks Than Loan Sharks: Illegal Lenders Prey on Vulnerable Communities

A recent report by the Scottish Illegal Money Lending Unit (SIMLU) reveals that up to 300,000 people in Scotland are at risk of falling victim to loan sharks. These illegal lenders are exploiting individuals struggling with the cost-of-living crisis, particularly by targeting those who find traditional banks too intimidating.

Unlike regulated financial institutions, loan sharks offer instant cash without credit checks, making them an easy but dangerous choice for those in financial distress. However, borrowers often find themselves trapped in an endless cycle of debt, facing threats and intimidation when they fail to repay.

The Growing Threat of Illegal Lenders

Research suggests that many victims turn to loan sharks due to a lack of accessible credit options. With doorstep lending services like Provident Financial shutting down, illegal lenders have stepped in, aggressively marketing their services via social media and even targeting individuals at food banks.

A disturbing case involved a Glasgow mother who borrowed £250 from a loan shark. When she missed a payment, the lender doubled her debt and later threatened both her and her child. This pattern of intimidation is common among illegal lenders, who rely on fear to enforce repayments.

How to Protect Yourself

Authorities emphasize that borrowing from a loan shark is not just risky—it’s illegal. Victims of illegal lending have rights, and organizations like SIMLU and Citizens Advice Scotland provide confidential assistance to those affected.

Five Essential Steps to Take if You've Borrowed from a Loan Shark:

Know Your Rights: You have not committed a crime; the loan shark has.

Report It Confidentially: Contact the Scottish Illegal Money Lending Unit (SIMLU) for support.

Seek Financial Advice: Get help from agencies like StepChange Debt Charity or Money Advice Scotland.

Access Emergency Support: Organizations can help with benefits checks, food bank referrals, and short-term financial aid.

Take Preventative Action: Learn about budgeting solutions and safe borrowing options, such as credit unions.

CCN's Commitment to Consumer Protection

At Compensation Claims News (CCN), we believe in protecting consumers from financial exploitation. Our platform provides up-to-date insights on financial mis-selling, debt solutions, and legal recourse for victims of unfair lending practices. If you or someone you know has been affected by illegal lending or financial mis-selling, we can help you understand your rights and explore potential claims.

Take Action Today

Don’t let loan sharks control your financial future. File a Claim or Get Protected now to explore your options and access professional support.

For the latest updates on consumer rights and financial justice, stay informed with CCN’s Latest News.

NEWS FROM FINANCIAL OMBUDSMAN SERVICE

We have announced that we will make our funding arrangement fairer by proceeding with a proposal to charge professional representatives £250 to refer a case to our service from 1 April 2025.

Professional representatives were behind around 47% of the cases sent to us between April and December 2024. We will charge professional representatives £250 to refer a case to our service from April. Professional representatives will receive £175 back if the case outcome is in favour of the consumer.

It will remain free for consumers to refer a complaint themselves, and for charities, families and friends who may be helping them. Professional representatives will be able to bring ten cases to the service for free each financial year. After that, every subsequent case they refer will be chargeable. They will receive £175 back in credit if the complaint is found in favour of the consumer they represent, reducing the charge they pay to £75.

We are and will remain free to all those who bring their cases directly, as well as to families and friends, charities, and voluntary organisations who may be helping them.

A large proportion of complaints referred to us in recent years have been driven by professional representatives who either charge consumers or take a percentage of any redress awarded. Currently financial service firms pay a £650 case fee for complaints against them that we investigate, while professional representatives do not pay a case fee.

Under the new rules, if a complaint referred by a professional representative is not upheld or is withdrawn, the financial business against whom the complaint was made will pay a reduced case fee of £475, instead of £650.

The move aims to make the funding arrangements for us fairer and to encourage professional representatives to submit better-evidenced complaints, considering their merits more diligently before referring them.

James Dipple-Johnstone, Interim Chief Ombudsman at the Financial Ombudsman Service, said:

"We've seen more cases brought by professional representatives, but fewer of these cases leading to a better outcome for their clients. Currently, there is little commercial incentive for representatives to ensure the complaints they bring are well-founded or have merit. As a not-for-profit service, we expend our finite resources handling thousands of withdrawn or abandoned cases, which can lead to longer wait times for other customers.

The charges we are introducing from April will bring better balance to our fee model, helping us to resolve disputes quickly and ensuring a wider contribution towards our running costs."

Between April and December 2024, around 47% of complaints submitted to us were from professional representatives. The professional status of these firms should mean that these complaints have a considerably higher success rate compared to consumers who use the service without professional representation. However, only 26% of cases brought by professional representatives were found in favour of the consumer, compared to 38% of those brought directly by consumers for free.

James Dipple-Johnstone added:

"Professional representatives can play an important role in resolving financial disputes by providing high-quality, good value services to those people who make an informed choice to employ them.

But it is important for consumers to know that it is and will remain free for them to bring a complaint directly to our easy-to-use service, and those who do so can keep all of any reward we make."

The fee is part of a wider range of measures being brought in to encourage firms to submit well-evidenced complaints. The introduction last year of an enhanced digital service means professional representatives must now provide relevant evidence at the earliest stage – speeding up processes and enabling us to dismiss inappropriate complaints.

The Baroness Manzoor CBE, Chairman of the Financial Ombudsman Service, said:

"I believe this marks an important and significant milestone in the financial services landscape, enabling us to continue our vital work in resolving disputes for both complainants and firms quickly and with minimum formality.

We will continue working closely with all stakeholders to ensure a smooth transition and to support CMCs and other professional representatives throughout this process."

Together with the Financial Conduct Authority (FCA), we recently ran a joint Call for Input looking at how to modernise the redress framework to ensure it is fit for the future. Sudden and significant increases in complaints – including those driven by professional representatives – can cause firms to struggle to effectively respond, delaying any customer redress that may be due.

Full details of the new charging regime are outlined in a policy statement (PDF 1MB) Charging professional representatives Policy statement published today. The proposal to charge a fee to professional representatives who refer cases to us has been subject to two consultations and the organisation published a summary of the feedback (PDF 229KB) Consultation-responses-Charging-Claims-Management-Companies-and-other-Professional-Representatives it had received in November last year.

In January, the FCA published a letter FCA: Claims Management Companies portfolio letter 2025 which outlined its strategy for supervising Claims Management Companies (CMCs). It said that it would undertake work to consider whether CMCs are investigating the merits of potential claims before referring a complaint, and that it would look at CMCs submitting high volumes of complaints to us but achieving low uphold rates.

Notes to editors

Professional representatives brought around 103,000 of the 220,000 complaints we received between April and December 2024.

‘Found in favour of the consumer’ or ‘upheld’ means that the case was closed as a change in outcome in favour of the complainant.

Respondent firms under our group charging arrangement operate on an agreed case fee basis which slightly differs from a strict £650 case fee chargeable per complaint.

Compensation Claims News (CCN) – Your Trusted Claims Partner

At Compensation Claims News (CCN), we believe in helping individuals and businesses navigate financial disputes and secure the compensation they deserve. If you think you've been mis-sold financial services or need expert assistance, our team is here to guide you.

✅ Get Informed, Stay Protected, and Take Action

File a Claim Now | Get Protected | Stay Informed

Equal Pay Victory: Landmark Case Against Next Retail Ltd.

FILE A CLAIM NOWIn a groundbreaking judgment announced on 5 August 2024, the employment tribunal ruled in favor of 3,500 female shop workers in their equal pay claim against Next Retail Ltd. and Next Distribution Ltd. The tribunal found significant pay disparities between female shop workers and male warehouse workers, deeming the difference unjustifiable and discriminatory. This ruling is expected to influence future equal pay cases across various sectors, including retail, and has sparked calls for widespread pay audits and transparency.

Case Overview

- Claimants: Approximately 3,500 current and former employees of Next Retail Ltd. and Next Distribution Ltd., with more women expected to join.

- Judgment Date: 5 August 2024.

- Outcome: Tribunal found evidence of unjustifiable pay disparities between predominantly female shop workers and male warehouse workers.

Key Findings

- Female shop workers performed work of equal value to male warehouse workers yet were paid up to £3 less per hour for years.

- Tribunal ruled this disparity amounted to indirect discrimination.

- Next's defense of "market forces" and cost management was deemed unjustifiable.

- Result: Next must pay an estimated £30 million in back pay and equalize pay rates moving forward.

Legal and Economic Implications

1. Impact on Employers

- Retail and other sectors urged to conduct equal pay audits to identify and address disparities proactively.

- Employers cannot use business viability as a defense against pay discrimination claims.

2. Wider Sector Relevance

- This ruling could influence ongoing cases like Brierley vs. Asda Stores Ltd., involving over 60,000 workers and potential payouts exceeding £1 billion.

- Employment law experts suggest the Next case may set a precedent for future claims.

3. Legislative Framework

- Equal Pay Act 1970 and Equality Act 2010 underpin such cases, but barriers like lengthy proceedings deter many claimants.

- Claims of indirect discrimination require proving disparities caused by policies disproportionately affecting protected groups (e.g., women).

Historical Context

- Similar judgments include the Birmingham City Council case (2012), where bonuses denied to female workers cost the council over £1 billion.

- The Enderby case (1997) set an earlier precedent for addressing gender-based pay disparities.

Call for Action

- Employment tribunals emphasize the need for pay transparency to combat systemic inequalities.

- Employers are encouraged to resolve pay discrepancies before litigation.

- Policymakers and campaigners advocate for stronger laws to ensure fair compensation and eliminate discrimination.

What This Means for Workers

- Equal pay audits and legal protections are essential tools to ensure fair treatment.

- Women in similar roles across various industries are encouraged to review their pay structures and seek legal support if needed.

Legal Framework for UK Employees

- Employers must adhere to the Equality Act 2010, ensuring no pay disparities for roles of equal value.

- Workers can lodge claims with employment tribunals, supported by trade unions or legal firms operating on a no-win, no-fee basis.

For more information on how to file an equal pay claim or report workplace discrimination. CLICK THE BUTTON BELOW

Christmas Flight Cancellations: Know Your Rights and Claim Compensation

During the recent festive season, many travelers faced significant disruptions as flights were canceled unexpectedly. Understanding your rights as a passenger can help you recover costs, claim compensation, and ensure your travel plans are protected

Passenger Rights Under UK & EU Laws (EC261/2004)

The UK Civil Aviation Authority (CAA) and EU Regulation EC261/2004 outline passenger rights for flight cancellations:

1. Right to a Refund or Rebooking:

- Airlines must offer a full refund or rebook you on the next available flight, even if it’s operated by a different carrier.

- Refunds must be processed within 7 days.

2. Right to Assistance:

- Stranded passengers are entitled to meals, refreshments, and accommodation if the cancellation causes an overnight delay.

- Transport to and from the accommodation should also be provided.

3. Right to Compensation:

- Compensation is payable if the cancellation was within the airline's control and announced less than 14 days before the flight.

- Compensation amounts (depending on flight distance):

- £220 for flights under 1,500 km.

- £350 for flights between 1,500 km and 3,500 km.

- £520 for flights over 3,500 km.

Common Causes of Flight Disruptions

- Operational Issues: Cancellations caused by airline-specific problems like staffing shortages or technical issues are compensable.

- Extraordinary Circumstances: Events like extreme weather or air traffic strikes may exempt airlines from compensation but not from providing assistance.

Steps to Take After a Flight Cancellation

1. Check Your Eligibility:

- Verify the cause of the cancellation with the airline.

- Review the timeline (e.g., when you were informed).

2. **Gather Evidence**:

- Keep all emails, boarding passes, and receipts for expenses.

- Record the cancellation reason if communicated by the airline.

3. **Submit Your Claim**:

- File directly with the airline or seek legal/professional help if the claim is denied.

- You have up to **6 years** to claim compensation under UK law.

#### **How CCN Supports Your Claims**

At **Compensation Claims News (CCN)**, we are dedicated to helping travelers:

- **Simplify the Process**: Our team manages your claim from start to finish, ensuring no detail is overlooked.

- **Maximize Compensation**: We assess your case thoroughly to secure the highest compensation you’re entitled to.

- **Stay Updated**: Keep informed on your claim's progress through our transparent system.

- **Expert Advice**: Benefit from industry knowledge and experience with passenger claims.

Special Considerations

- **Non-EU Airlines**: Flights operated by non-EU airlines are covered if departing from a UK/EU airport.

- Package Holidays: If your flight is part of a package holiday, additional protections under package travel laws may apply

Take Action Now

Don’t let the inconvenience of a flight cancellation go unresolved. Protect your rights and claim what you’re owed.

- File a Claim with CCN today. Let us handle the complexities while you focus on your journey.

BT Wins £1.3bn Class Action Lawsuit Alleging Overcharges to Millions of Customers. But an appeal may still come

FILE A CLAIM NOWBT has successfully defended itself in a £1.3 billion ($1.6bn) class action lawsuit that alleged the telecom giant overcharged millions of customers for fixed telephone lines. While the verdict was a significant win for BT, the case has broader implications for businesses, the telecom industry, and consumers.

Case Summary

The lawsuit, led by former Ofcom official Justin Le Patourel, accused BT of overcharging approximately 3.7 million landline customers between 2009 and 2017. Many of these customers were elderly individuals relying on standalone fixed voice (SFV) connections.

The Competition Appeal Tribunal acknowledged BT's excessive pricing but ruled that it was not "unfair" and that the company had not abused its dominant market position. The ruling, documented in a 301-page verdict, dismissed the claim, but an appeal remains possible.

BT’s Response

In a brief statement, BT welcomed the ruling and emphasized its commitment to customers:

"We take our responsibilities to all of our customers very seriously and welcome today's ruling."

The Lead Claimant’s Perspective

Justin Le Patourel expressed disappointment with the outcome, stating:

“While I am pleased that the tribunal has recognized BT’s dominant position in the market and the significant and persistent nature of its excessive pricing, I am disappointed that it did not agree that these prices were unfair.”

Le Patourel is considering an appeal, potentially extending the legal battle.

Potential Lessons for Businesses

- Transparency in Pricing: Ensure that pricing structures are clear and justifiable to avoid allegations of exploitation.

- Customer-Centric Approach: Actively consider the needs of vulnerable customers and proactively address pricing concerns.

- Regular Audits: Conduct periodic reviews of pricing policies to ensure compliance with laws and maintain consumer trust.

- Proactive Communication: Engage openly with regulators like Ofcom to address potential issues before they escalate.

Broader Implications for the Telecom Industry

- Increased Scrutiny: This case underscores the need for telecom companies to adopt fair pricing practices under regulatory oversight.

- Precedent for Class Actions: Such lawsuits could embolden consumers and advocacy groups to challenge dominant industry players.

- Evolving Expectations: With growing awareness of consumer rights, companies must adapt to a more informed customer base.

- Steps Consumers Can Take

- Review Bills Regularly: Always check for unexplained charges or price hikes.

- Know Your Rights: Familiarize yourself with laws like the Consumer Rights Act 2015 and Ofcom’s regulations.

- Raise Disputes: Contact your provider directly if you suspect unfair charges.

- Seek Support: Utilize resources like Citizens Advice or telecom ombudsman services.

- Consider Legal Action: In cases of systemic issues, joining a class-action lawsuit might be a viable solution.

Call to Action for CCN Readers

Have you experienced unfair treatment or overcharges by service providers? File a Claim with us at Compensation Claims News (CCN). Our team is dedicated to helping you navigate the claims process and secure the justice you deserve.

File a Claim Now by clicking the button below

Final Thoughts

While BT has emerged victorious in this legal battle, the case highlights the critical need for fairness and accountability in pricing strategies. Both businesses and consumers can draw valuable lessons from this landmark ruling, ensuring a fairer marketplace for all.

References

- Competition Appeal Tribunal Verdict: A detailed analysis of the 301-page judgment can be accessed on the official Competition Appeal Tribunal website.

- Ofcom Regulations: Learn more about consumer protections and telecom regulations at www.ofcom.org.uk.

- Citizens Advice: Guidance on telecom complaints and consumer rights available at www.citizensadvice.org.uk.

- Media Coverage: Coverage of the case provided by reputable outlets, including BBC News and The Guardian.

UK Personal Injury Claims Drop Amid Motor Claim Reforms

However, some claims rise as reforms reshape the landscape

Case Summary

Recent data from the UK government’s Compensation Recovery Unit (CRU) has revealed a shift in personal injury claims, showing both declines and increases in various categories. While motor claims remain the largest liability type, their numbers have declined due to ongoing reforms, reshaping the claims landscape in the UK.

Detailed Breakdown of the CRU Data

From January to September 2024, the CRU recorded a total of 347,168 personal injury claims, categorized as follows:

- Clinical negligence claims: 11,079

- Employer liability claims: 34,847

- Motor claims: 245,028

- Other liabilities: 7,450

- Public liability claims: 48,081

- Unknown cases: 683

Motor claims, though still the largest volume of claims, saw a significant 11% decline in Q3 2024 compared to the same period in 2023. This drop aligns with government reforms targeting whiplash claims and other minor injury-related compensations.

Expert Commentary

Matthew Maxwell Scott, the executive director of the Association of Consumer Support Organisations (ACSO), highlighted the implications of the data, stating:

"The decline is especially relevant in light of the government’s announcement that it is to investigate the high price of motor insurance through the Motor Insurance Taskforce. Not even the most vociferous advocate for the insurance industry can now assert that soaring premiums are the fault of all those making minor injury claims."

Maxwell Scott also emphasized the importance of sustaining the claims market, urging the government to make timely decisions regarding the new whiplash tariff and updated medical report costs.

Emerging Trends

The CRU data showed a 25% rise in public liability claims, marking a 32% increase from the previous quarter. While this surge could signal a developing trend, it is unclear if it represents a temporary fluctuation.

In contrast:

Employer liability claims and clinical negligence claims have remained stable.

The sustainability of firms supporting injured individuals remains a key focus.

"It is important that the rights of injured people to obtain redress for non-fault accidents are supported by ministers," Maxwell Scott added, emphasizing the need for a robust and sustainable future for the industry.

Conclusion

While reforms have successfully reduced motor claims, their broader impact on the personal injury claims market remains complex. The government and industry stakeholders must balance reforms with ensuring fair access to compensation for injured individuals.

By Kenneth Araullo

Sources:

- CRU Data (January–September 2024)

- Comments from Matthew Maxwell Scott, ACSO

First Compensation Payments Offered to Victims of Infected Blood Scandal

Government Takes Historic Step Toward Justice with Initial £13 Million in Payments

In a landmark move, the UK government has begun delivering compensation payments to victims of the infected blood scandal, marking the culmination of decades of advocacy and persistent calls for justice.

The initial compensation offers, totaling over £13 million, have been extended to ten individuals, with the first few recipients accepting their payments. These payments are the first to be issued by the Infected Blood Compensation Authority (IBCA), established earlier this year as part of the government’s commitment to redress the injustices suffered by victims.

Key Developments in Compensation

Ten victims have received compensation offers, with 25 more individuals invited to submit their claims.

The government allocated £11.8 billion in the Budget to fund the comprehensive compensation scheme.

Payments are being managed by the IBCA, an independent body set up in May 2024 on recommendations from the Infected Blood Inquiry.

Sir Robert Francis KC, interim chair of the IBCA, continues to engage with the infected blood community to refine the scheme and widen its reach.

The Compensation Scheme

The UK-wide compensation program is rooted in recommendations from the Infected Blood Inquiry, guided by Sir Robert Francis KC and a panel of independent experts in legal, healthcare, and financial fields.

Updated in August 2024, the scheme incorporates further recommendations to address the needs of those infected and affected by the scandal. The IBCA plans to expand the compensation service early in the New Year, ensuring broader access to justice for victims and their families.

Official Statements

Nick Thomas-Symonds MP, Paymaster General and Minister for the Cabinet Office, described this development as a "vital step toward delivering justice."

“No amount of compensation can fully address the suffering caused by this scandal, but I hope this demonstrates our commitment to delivering significant compensation for those impacted,” said Thomas-Symonds.

He emphasized that the government’s allocation of £11.8 billion for the scheme reflects its dedication to addressing the decades of injustice experienced by victims.

What This Means for Victims

After years of suffering and advocacy, the first recipients of the compensation payments represent a milestone for the infected blood community. As the IBCA prepares to open the scheme further in 2025, more victims will have the opportunity to claim the financial redress they deserve.

Take Action Today

File a Claim: If you or a loved one have been affected by the infected blood scandal, don’t wait. Begin your claim now and let us assist you in navigating the process for fair compensation.

Get Protected: Stay informed about your rights and the latest developments in compensation services.

Disclaimer:

This article is based on publicly available information from the Cabinet Office, Nick Thomas-Symonds MP, and the Infected Blood Compensation Authority. It is intended for informational purposes only and does not constitute legal advice. Claimants should seek professional guidance for their specific circumstances.

Sources:

- Cabinet Office

- Statements from Nick Thomas-Symonds MP

- Infected Blood Compensation Authority

Personal Injury Discount Rate Updated for England and Wales

Changes Aim to Reflect Current Economic Conditions and Provide Fair Compensation

The personal injury discount rate (PIDR) in England and Wales has been updated to better align with current economic realities. The PIDR is a key factor in determining lump sum damages for victims of serious and long-term personal injuries caused by negligence.

Key Highlights

The PIDR has changed from -0.25% to +0.5%, effective 11 January 2025, following the Lord Chancellor’s decision.

The new rate influences how future losses are calculated for serious personal injury claims.

The review involved an independent expert panel chaired by the Government Actuary and comprehensive analysis from the Government Actuary's Department (GAD).

Purpose of the PIDR

Lump sum damages aim to provide fair compensation by accounting for:

Future Losses: Anticipated costs and financial needs arising from the injury.

Investment Returns: The return claimants are expected to earn by investing the awarded sum.

GAD’s Role and Future Reviews

The Government Actuary's Department plays a pivotal role in reviewing the PIDR every five years. This process includes consulting an expert panel and advising the Lord Chancellor.

As part of this latest update, GAD’s extensive analysis has been published alongside the PIDR Expert Panel’s report, ensuring transparency and accountability in the decision-making process.

What This Means for Claimants

For claimants, the revised PIDR reflects updated economic conditions, ensuring a fairer calculation of compensation for future financial losses. The changes are set to benefit those pursuing personal injury claims starting in 2025.

Take Action Today

File a Claim: If you or someone you know is pursuing a personal injury claim, act now to ensure your case reflects the new PIDR changes.

Disclaimer:

This article is based on publicly available information from the Government Actuary’s Department and the Ministry of Justice. It is intended for informational purposes only and does not constitute legal or financial advice. Claimants should consult with legal professionals for advice tailored to their case.

Sources:

Government Actuary’s Department

Ministry of Justice

Almost £2 Million Claimed Under Riot Compensation Act

UK Faces Financial and Social Fallout from Last Summer's Widespread Disorder

Almost £2 million has been claimed so far under the Riot Compensation Act (RCA), following extensive damage caused by riots across the UK last summer. The unrest erupted after the tragic killing of three young girls at a children’s dance event in Southport and subsequent misinformation about the suspect's background.

The Scope of the Damage

According to the Association of Police and Crime Commissioners (APCC), 88 claims have been registered for compensation, amounting to approximately £1.9 million. However, this figure is not final and could increase as further claims are processed.

The riots resulted in significant property damage, including:

Vandalized buildings, including mosques and hotels housing asylum seekers.

Looted shops and damaged vehicles.

A library set ablaze, later receiving £250,000 in donations for repairs and enhancements.

How the Riot Compensation Act Works

The Riot Compensation Act allows individuals or businesses to claim compensation for property damage, destruction, or theft resulting from riots if their losses are not covered by insurance. Insurers may also claim reimbursement after settling claims for their clients.

Compensation funds are generally drawn from local police and crime commissioners’ budgets or the local mayor's office.

Regional Breakdown

Claims authorities in regions such as Merseyside, Greater Manchester, and Derbyshire have reported receiving compensation requests.

Merseyside alone received 30 claims totaling over £799,000, the highest amount recorded so far.

Merseyside Police and Crime Commissioner Emily Spurrell emphasized the importance of ensuring victims receive the support they need, particularly those uninsured or denied coverage by their insurers.

Ongoing Impact and Support

As the review of claims continues, victims of the riots are encouraged to apply under the Riot Compensation Scheme to secure financial redress. The full financial and social cost of the unrest remains unquantified but highlights the far-reaching consequences of misinformation and communal tensions.

How CCN Can Help You

At Compensation Claims News (CCN), we’re here to help you:

- Understand Your Rights: Get expert advice on whether you qualify under the Riot Compensation Act.

- File and Process Claims: Let us guide you through the process of submitting your claim efficiently and accurately.

- Maximize Your Compensation: Ensure you receive the financial support you’re entitled to, even if insurance has failed you.

Take action now:

File a Claim: Start your claim today with the help of CCN.

Get Support: Reach out for personalized assistance.

Disclaimer:

This article is based on publicly available information from the BBC, APCC, and other verified sources. It is intended for informational purposes only and does not constitute legal advice. Claimants are encouraged to consult with professionals for guidance specific to their situation.

Sources:

- BBC News

- Association of Police and Crime Commissioners

- Statements from Merseyside Police and Crime Commissioner

Waspi Women Denied Compensation – But What Other Compensation Bills Are Looming?

Exploring the Government's Burgeoning Financial Commitments

The government's decision to reject compensation for the Women Against State Pension Inequality (Waspi) campaign has ignited public outcry. This refusal leaves many of the 3.6 million women born in the 1950s, who were affected by changes to the state pension age, feeling overlooked.

The Waspi Campaign: A Fight for Justice

The Waspi campaign argues that affected women were inadequately informed about the rise in the state pension age, implemented to equalize pension eligibility with men. The Parliamentary and Health Service Ombudsman recommended compensation ranging between £1,000 and £2,950 per woman earlier this year.

However, the government has refused these recommendations, citing a cost of £10.5 billion as unjustifiable for taxpayers. Ministers have apologized for delays in communication but have stopped short of offering financial redress.

A Change in Political Promises

Labour, now in power, has faced criticism for not including Waspi compensation in its 2024 manifesto, despite previous promises in its 2017 and 2019 manifestos. Prominent figures like Work and Pensions Secretary Liz Kendall had publicly supported the campaign while in opposition, fueling further frustration among campaigners.

A Broader Context of Compensation Claims

Waspi women are not alone in seeking justice. The government is grappling with multiple compensation schemes addressing historical injustices, including:

Infected Blood Scandal: Victims have started receiving payouts after decades of campaigning.

Riot Compensation Act Claims: Nearly £2 million has already been claimed following widespread riots last summer.

Post Office Horizon Scandal: Sub-postmasters wrongfully accused of theft are being compensated for life-changing damages.

As these bills pile up, the government faces difficult choices about how to fund redress while managing taxpayer concerns.

How CCN Can Support You

At Compensation Claims News (CCN), we specialize in helping individuals and groups understand and navigate their rights to compensation.

Expert Guidance: Learn if you qualify for compensation under government schemes.

Claim Assistance: Get support filing claims effectively and accurately.

Advocacy Support: Stay informed about ongoing campaigns and your role in achieving justice.

Take Action Today

[File a Claim]: Start your compensation journey with CCN's expert help.

[Get Advice]: Contact us for personalized assistance tailored to your situation.

Disclaimer:

This article is based on publicly available information from the BBC, Waspi campaign, and other verified sources. It is intended for informational purposes only and does not constitute legal advice. Individuals are encouraged to consult professional advisors for specific guidance.

Sources:

BBC News

Parliamentary and Health Service Ombudsman Reports

Aviva to Cut Jobs at Scottish Base Following Major Acquisition

Job Losses Expected

Insurance giant Aviva plans to cut between 5-7% of its workforce at its Perth office, equating to approximately 77 positions. These reductions come as part of broader cost-saving measures following the company's £3.7 billion acquisition of rival insurer Direct Line.

Company Statement

An Aviva spokesperson confirmed:

“The cost synergies from the acquisition are expected to be achieved through a reduction in overlapping roles across the combined insurance operations, rationalisation of supporting teams, and reductions in shared services, head office, and senior management functions.”

The firm has stated its aim to achieve £125 million a year in cost savings, with potential job cuts across its operations totaling 2,300 positions.

Impact on Scotland

Aviva, one of Perth's largest employers, operates its office in Pitheavlis, Perth, and also maintains a site at Eurocentral, near Glasgow. While the exact distribution of job cuts between these locations remains unclear, the potential losses could significantly impact the local workforce.

Community Reaction

The announcement has raised concerns among employees and local communities. The Scottish Sun has reached out to Aviva for additional comments on the planned redundancies and potential support for affected staff.

More Updates on Aviva and the Industry

The acquisition of Direct Line marks a major shift in the insurance sector, with companies seeking efficiencies amidst increasing competition.

Keep an eye on further developments and advice for affected employees by staying updated.

Stay Informed

Firms Given Deadline Extension for Motor Finance Complaint Responses

Deadline Extended to December 2025

Firms handling motor finance complaints, including those not involving Discretionary Commission Arrangements (DCAs), now have until 4 December 2025 to provide final responses. This extension aligns with the timeline already set for complaints involving DCAs, ensuring orderly and consistent outcomes for both consumers and firms.

Key Developments Leading to the Extension

- Court of Appeal Decision:

- On 25 October 2024, the Court of Appeal ruled it unlawful for car dealers to receive commission from lenders without first disclosing this to customers and obtaining informed consent.

- The judgment highlighted breaches of common law, equitable principles, and the Consumer Credit Act, rather than FCA rules.

Supreme Court Appeal

- The Supreme Court has agreed to hear an appeal against this ruling.

- While the appeal progresses, firms must adhere to the law as interpreted by the Court of Appeal for new agreements.

Impact on Consumers

- Extended Complaint Deadlines: Consumers can now refer non-DCA complaints to the Financial Ombudsman up to 29 July 2026 or 15 months after receiving a final response, whichever is later.

- Inclusion of Motor Leasing: Following feedback, the FCA confirmed that the extension also applies to motor leasing agreements, ensuring consistent treatment for similar products.

FCA Actions and Expectations

- Good Practice Guidelines:

- The FCA has issued a summary of the Court of Appeal decision and examples of good and poor practices for firms.

- Review of Historical DCAs:

- In January, the FCA began reviewing historical motor finance DCAs to determine potential misconduct and ensure appropriate compensation.

- Delays in obtaining necessary data led to the extended response deadline for complaints.

Next Steps

May 2025 Updates:

- The FCA aims to announce next steps for DCA reviews and provide updates on non-DCA complaints, pending progress in the Supreme Court appeal.

- The complaint handling extension may end earlier if feasible.

Market Continuity:

- The FCA’s priority remains balancing consumer compensation with maintaining market efficiency and competition in the motor finance sector, which serves over 2 million consumers annually.

What Should Consumers Do?

If you suspect you overpaid for motor finance due to undisclosed commissions:

File a Complaint.

Consumers Win Landmark UK Car Finance Mis-Selling Case: Billions in Compensation at Stake

The UK Court of Appeal has issued a groundbreaking ruling in favor of borrowers in a car finance mis-selling case, a decision that may lead to billions of pounds in compensation claims. This case sheds light on the unethical commission practices employed by lenders and marks a critical step in protecting consumer rights.

Key Highlights of the Case

Unlawful Commission Practices:

The court ruled it was unlawful for lenders to pay commissions to car dealers without informing borrowers. Consumers should have been made aware of all relevant facts, including the total commission and its calculation method, to make informed decisions.

Test Cases Involved:

The decision combined claims against FirstRand Bank and Close Brothers, setting a precedent that could ripple across the car finance sector.

Broad Implications:

The ruling could lead to car loans being rescinded or written off and trigger compensation claims amounting to £8 billion to £13 billion.

Industry Response

Lenders’ Reactions:

Both FirstRand and Close Brothers intend to appeal the ruling in the UK Supreme Court. Close Brothers temporarily paused issuing car loans, while FirstRand expressed disagreement with the judgment.

Stock Market Impact:

Close Brothers’ shares dropped 15%, and Lloyds Banking Group saw a 5.5% dip, underscoring the financial risk tied to this ruling.

FCA’s Role:

The Financial Conduct Authority (FCA) is expected to assess the implications of the ruling and may decide on a consumer compensation scheme by May 2025. The FCA has already advised lenders to reserve funds for potential payouts.

Historical Context: Discretionary Commission Arrangements (DCAs)

From 2007 to 2021, DCAs allowed car dealers and brokers to set interest rates on loans, earning higher commissions by inflating rates. This practice was banned in 2021 after concerns arose about its impact on consumers.

While some argue that DCAs enabled flexibility in pricing to secure sales, the courts have now emphasized transparency and consumer protection over profit-driven incentives.

Wider Implications for Consumers and the Industry

A New Wave of Compensation Claims:

This case has been compared to the payment protection insurance (PPI) scandal, which cost banks over £50 billion. The potential compensation could dwarf previous claims cases, significantly impacting lenders’ balance sheets.

Consumer Empowerment:

The judgment strengthens the precedent that lenders must provide full transparency to borrowers. This could encourage more consumers to come forward with claims.

Future of Lending Practices:

As legal challenges mount, lenders may adopt stricter compliance measures to avoid regulatory scrutiny.

Call to Action: Protect Your Rights

If you suspect you’ve been mis-sold a car loan due to undisclosed commission practices:

File a Claim:

Explore your options to recover compensation. Our team at Compensation Claims News (CCN) can guide you through the process.

Stay Informed:

Follow our updates on financial scandals and consumer rights.

Get Protected:

Learn about your rights and how to safeguard against future financial mis-selling.

This ruling is a significant win for UK consumers and a wake-up call for the car finance industry. Transparency and ethical practices are no longer optional—they are a necessity. File your claim today to secure the justice you deserve.

Union Leaders Demand Compensation for 1980s Miners Affected by Thatcher-Era Strikes

The trade unions are urging Chancellor Rachel Reeves to allocate compensation for miners impacted during the infamous 1984-85 miners’ strike, citing parallels with recent payouts for victims of the infected blood and Post Office Horizon scandals.

The Call for Justice

Matt Wrack, general secretary of the Fire Brigades Union and former TUC president, is at the forefront of this campaign. He highlighted the toll on miners during the strikes, which saw:

- 11,313 arrests

- 7,000 injuries

- 5,653 trials

- 960 job terminations

- 200 imprisonments

“These figures represent more than statistics; they embody lives and communities irreparably damaged by politically motivated actions under Margaret Thatcher’s government,” Wrack said.

The union leader demands that the government acknowledge and compensate the miners for what he describes as state-led persecution and violence.

Historical Context: A Defining Era of Union Conflict

The 1984-85 strike, led by Arthur Scargill and the National Union of Mineworkers, marked a turning point in Britain’s industrial history. Events like the Battle of Orgreave became iconic of the fierce clashes between miners and police. Critics argue that these actions were part of a broader campaign to suppress union influence, with lasting repercussions for mining communities.

Government Response and Political Debate

While Rachel Reeves has allocated significant funds for recent scandals—£11.8 billion for the infected blood scandal and £1.8 billion for the Post Office Horizon scandal—there has been no indication of compensation for the miners.

Labour Leader Sir Keir Starmer’s Position:

Starmer has so far avoided supporting a formal inquiry into the miners’ strike but has engaged in discussions on other historical injustices, including reparations for slavery.

This openness has provided campaigners with cautious optimism for future redress.

Why Compensation Matters

Union leaders argue that compensating miners is not only a matter of historical justice but also essential for repairing the damage to mining families and communities. The financial, emotional, and social toll of the strikes lingers decades later, with many affected individuals still facing hardship.

Delays and Declines: What's Happening?

Amazon Flex Drivers File Over 15,000 Claims for Unpaid Wages and Overtime Date: June 12, 2024

FILE YOUR CLAIMIn a landmark move, more than 15,000 Amazon Flex drivers have filed legal claims against the e-commerce giant, alleging misclassification as independent contractors. The drivers claim that Amazon's practices have denied them fair wages, overtime pay, and essential employee benefits, sparking renewed scrutiny of labor rights in the gig economy.

The Gig Economy Under Fire

The rise of gig work has redefined modern employment, with millions of Americans earning income through apps like Amazon Flex, Uber, and DoorDash. However, the flexibility these platforms offer often comes at a cost, as workers report being denied protections afforded to traditional employees.

Key Issues Raised by Drivers

Unpaid Overtime and Wage Disparities:

Amazon Flex drivers argue they are compensated only for pre-scheduled time blocks, even when deliveries take longer than anticipated. For example, if a driver books a three-hour delivery block but takes four hours to complete the route, they are still paid for only three hours.

Expenses Without Reimbursement:

Drivers claim they must cover significant out-of-pocket expenses, including gas, vehicle maintenance, and phone bills. In California, Massachusetts, and Illinois, where these claims were filed, labor laws mandate reimbursement for such costs if workers are classified as employees.

Lack of Protections:

Without employee status, drivers miss out on essential benefits such as healthcare, paid leave, and workplace protections, leaving them financially vulnerable.

Broader Implications

Economic Impact of Misclassification

Worker misclassification is not just a personal issue—it’s an economic one. According to a report by the National Employment Law Project, worker misclassification costs U.S. states an estimated $3 billion annually in unpaid taxes, as companies avoid paying payroll taxes and benefits.

Legal Precedents