How Do You Know That You Have a High Chance of Claim?

You will know that you have a high chance of your claim once you determine every important aspects of your claim.

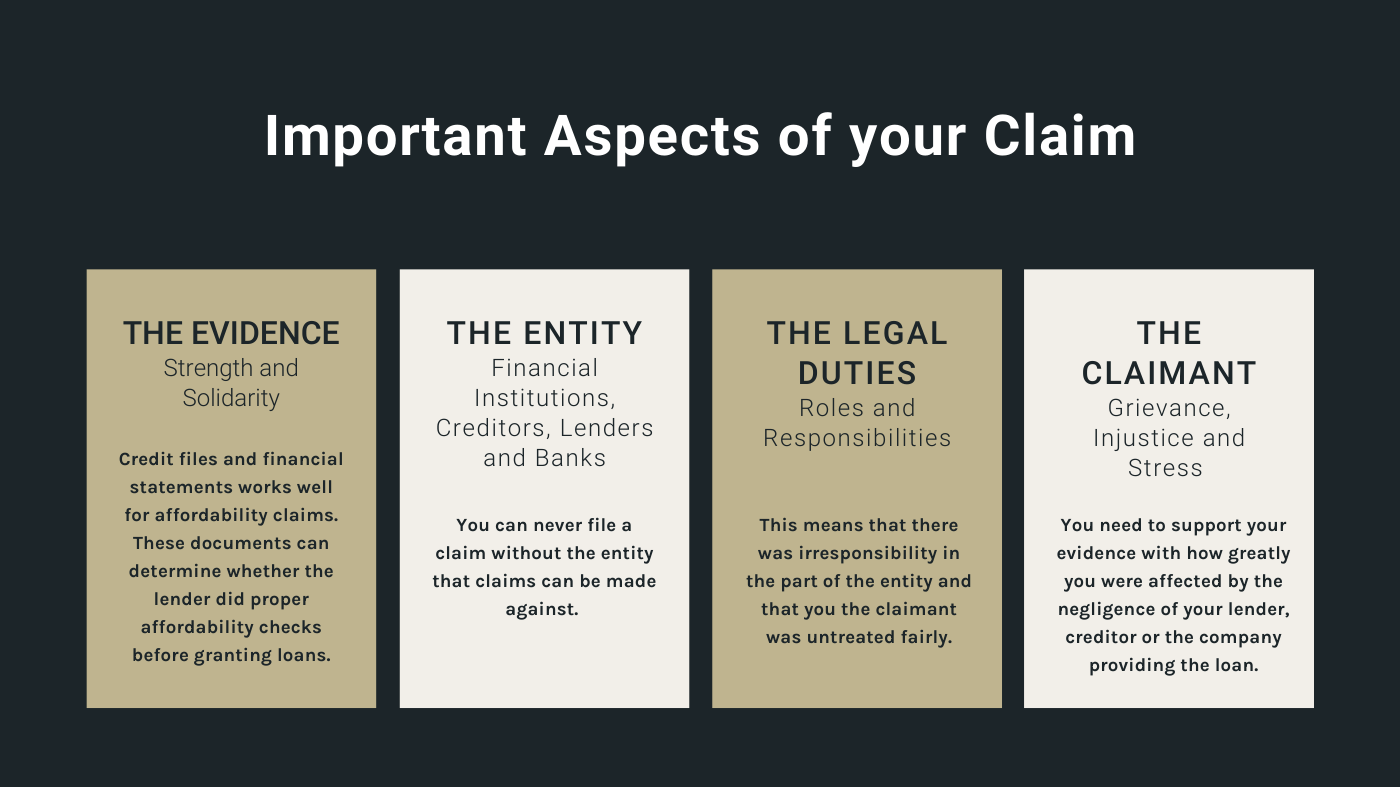

- The solidity and strength of your evidence - Your evidences will determine the reasonable chance in winning a claim. For an affordability claim the best evidence you’ll need is your credit file or credit history and financial statements since affordability claim is a complaint against a lender or creditor for irresponsible lending and for failing to do a proper affordability check before granting you loans. For a mis-sold insurance claim you need to prove that you were never given the accurate information about how the policy works.

- The entity that the claim can be made against – This refers to any of the following: financial institution, creditor, lender and the bank that provided the loans or the company providing the mis-sold insurance. You can never file a claim without the entity that claims can be made against.

- The financial institution, creditor, lender and the bank that provided the loans or the company providing the insurance has a duty of care to the claimant and was negligent in fulfilling that duty – This means that there was irresponsibility in the part of the entity and that you the claimant was untreated fairly.

- The grievance, injustice and stress of the claimant – You need to support your evidence with how greatly you were affected by the negligence of your lender, creditor or the company providing the mis-sold insurance.

If those above mentioned are complete and you have evaluated or assessed that you have all that it takes to file a compensation claim, and then you are likely to have a high chance of winning a claim. If you are having a hard time determining if you have a high chance of claim and you don’t have enough time and energy to collate all those needed for your claim. You can always check with a claims management company who can work this out for you. You’ll never know if you won’t try, you might be entitled for hundreds or thousands of pounds compensation.