Better than IVA - Individual Voluntary Agreement

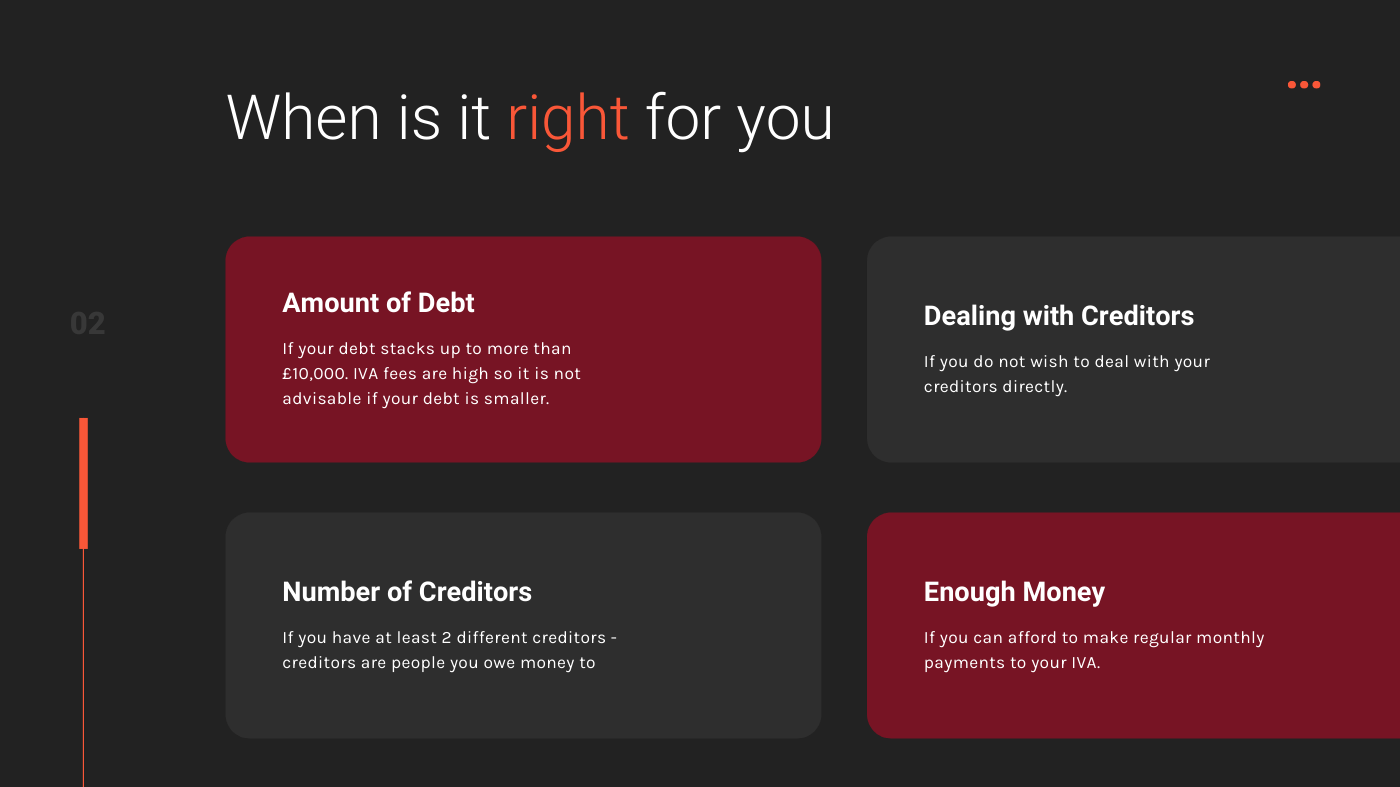

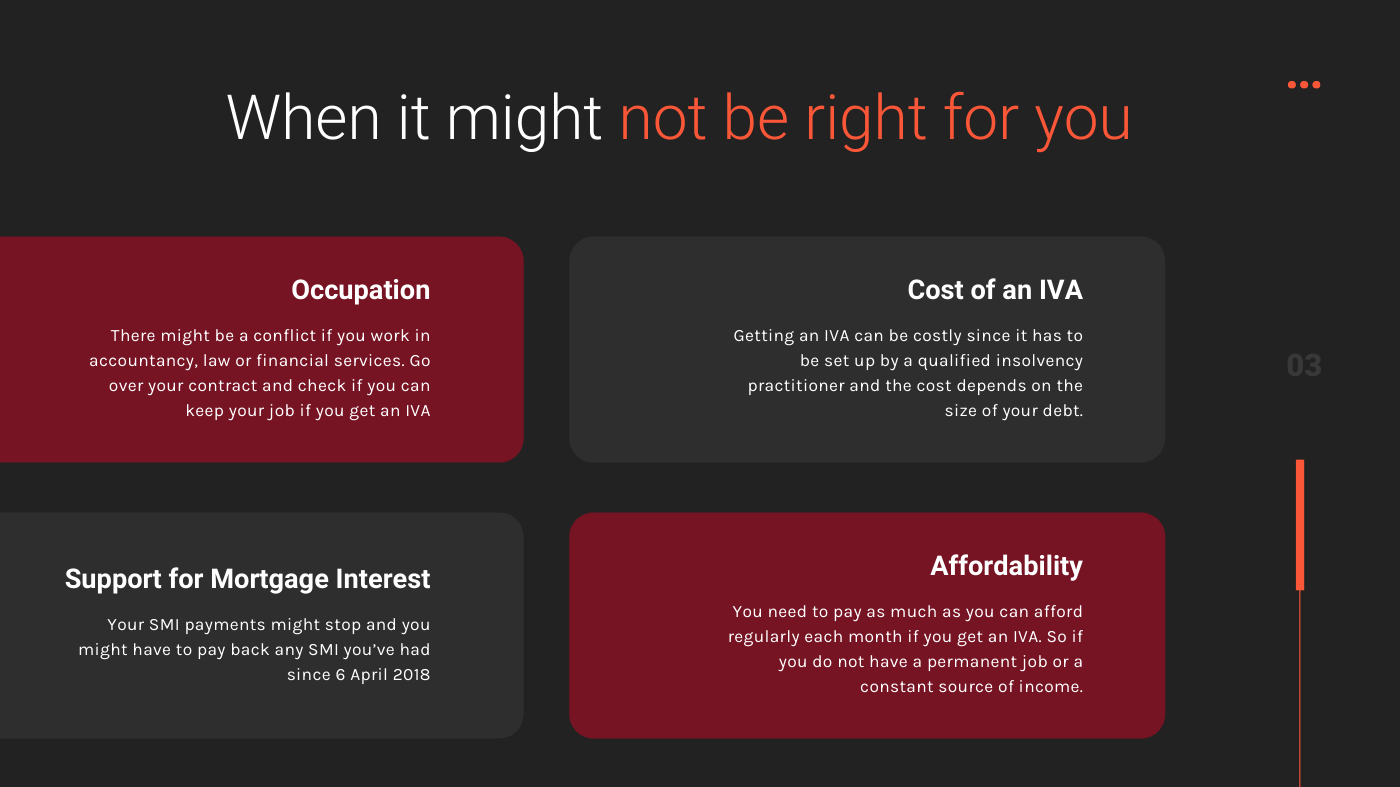

You might want to think it over before committing to an IVA

There is a better course of action than choosing an IVA. An alternative to an IVA is to consult a claims management company if a refund claim better suits you. If you believed that the cause of having into a debt trap cycle is that your creditors did not do a proper affordability check of your finances and credit history when they provided you the credit or the loans. If you think that the loans provided to you made you broke, forced you to having to loan more and to roll over loan top ups to pay loans or debts and you believed that the loans were unaffordable. Then you have a big chance to qualify for a refund claim for all the interests you have paid on the loans. Not only that you’ll get a refund on those interest and charges from the loans, but you’ll also get to improve your credit score or credit rating. Claims management companies only charge you once you are awarded with the cheque from your refund claim compensation. Most claims management companies have this “No Win, No Fee” policy, so you there is no risk on spending a hefty sum out from your pocket to pay for their service. Normally they charge 20% and up for the fees for their service and they are taken out from the award money from your compensation claim. No risk involved because you only pay them if you win.

To sum it all up either an IVA or using a claims management company for a refund claim, the decision depends on you. If you are willing to risk spending your money, savings and possessions then an IVA might be for you but if you wanted something better than IVA then a refund claim with the help of a reputable claims management company is the right option for you. You don’t get to spend your money, you only pay the fees when you win and get the award money from your creditors plus your credit rating will be improved. The high risk or the no risk at all…