Debt Trap: Escape The Endless Debt Cycle

Being in debt is not that bad as long as you are able to manage your debt and finances

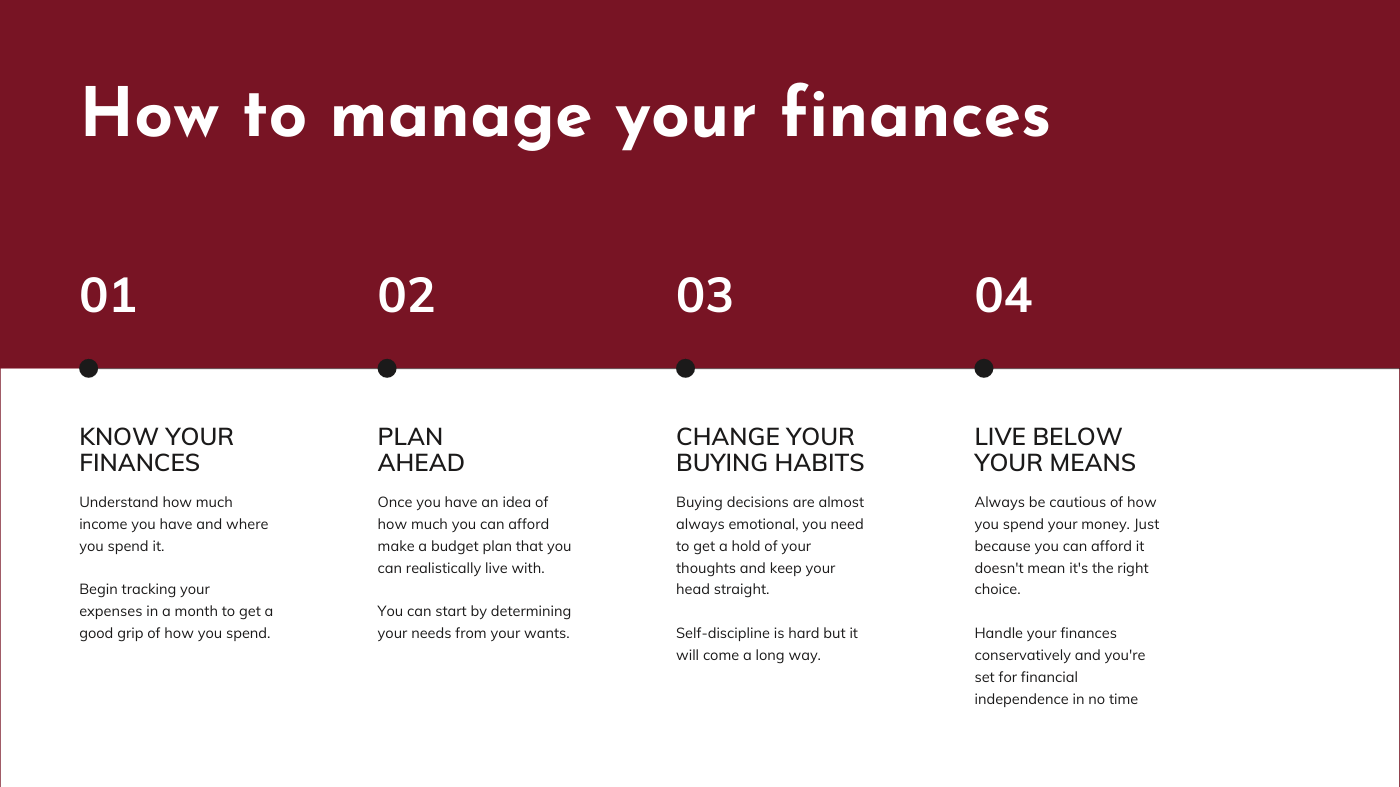

Avoiding an endless debt cycle can be done by changing your habit step by step until you are able to dig yourself out of the hole. But if you believed that your endless debt cycle was administered or enforced by your lender or your doorstep loans agent, seek help from a reputable claims management company who can look into the details for you and help you build a solid case for a successful compensation claim against your lender.