Did you know you were taxed from the PPI Compensation you received? We can help you claim that Tax back.

PPI Tax Refund Claim

| Total PPI reclaim | Tax taken for PPI taken out 3 yrs before | Tax taken for PPI taken out 5 yrs before | Tax taken for PPI taken out 10 yrs before |

|---|---|---|---|

| £1,000.00 | £40.00 | £60.00 | £100.00 |

| £3,000.00 | £120.00 | £180.00 | £300.00 |

| £7,500.00 | £300.00 | £460.00 | £730.00 |

| £15,000.00 | £610.00 | £910.00 | £1,470.00 |

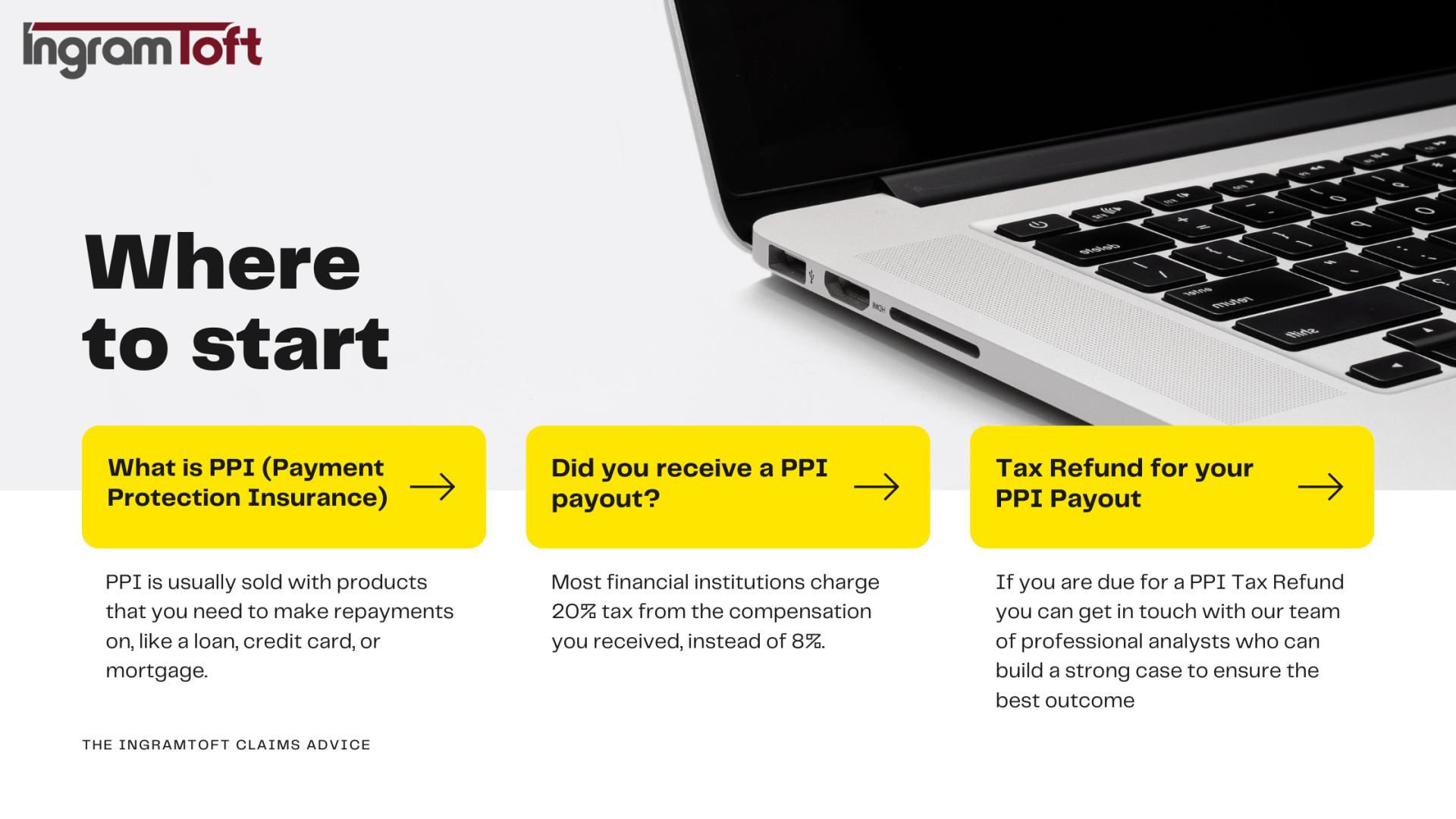

Even if you are self-employed, a freelancer or you work for a company; you should be aware of the amount of the refundable tax. Most of the banks that refunded the PPI did not know exactly how much tax you pay and that is why most of them assumed that you belong into the basic category and deducted 20%. This means that most of those individuals in basic rate and even individuals who are non-tax payers may be able to reclaim on the governments tax-free savings allowance.

If you are interested if you are due for a PPI Tax Refund you can get in touch with our team of professional analysts who can build a strong case to ensure the best outcome. We provide 100% online consultation and No Win No Fee policy.